Now Reading: Trump’s Tariff Agency Proposal Sparks Confusion Among Experts

-

01

Trump’s Tariff Agency Proposal Sparks Confusion Among Experts

Trump’s Tariff Agency Proposal Sparks Confusion Among Experts

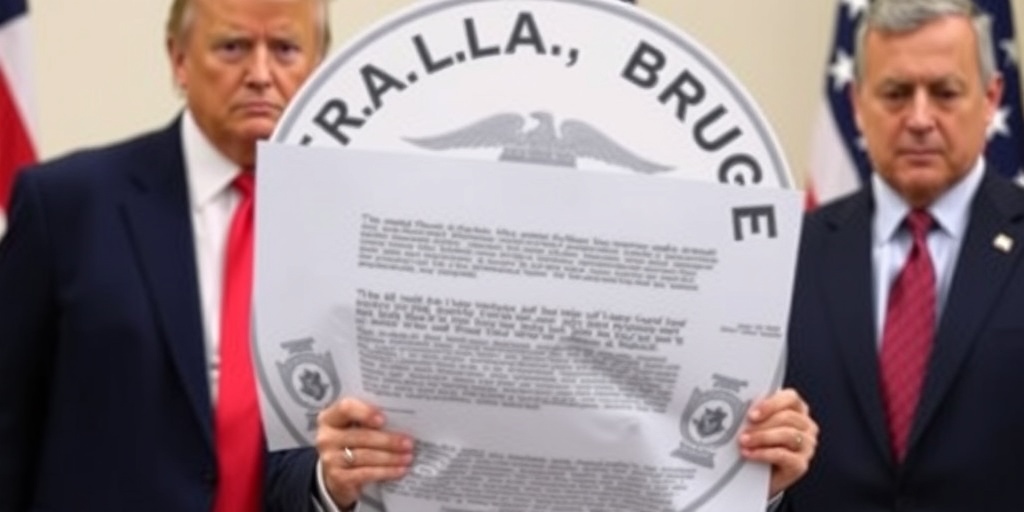

Trump Proposes New Revenue Agency to Collect Tariffs Amid Controversy

In a bold economic move, President Trump has vowed to generate significant revenue through tariffs on foreign products, proclaiming the establishment of a new agency, dubbed the External Revenue Service (ERS), to oversee the collection of these funds. During his inaugural address, Trump emphasized a shift in the U.S. revenue strategy, stating, "Instead of taxing our citizens to enrich other countries, we will tariff and tax foreign countries to enrich our citizens. It will be massive amounts of money pouring into our Treasury coming from foreign sources."

However, details about the proposed ERS remain ambiguous, particularly concerning its function compared to existing governmental operations. Trade specialists warn that most tariff revenue will still come mainly from U.S. businesses that import foreign goods rather than directly from the countries producing them.

The current system for tariff collection is well-established. U.S. Customs and Border Protection (CBP) operates the process, monitoring goods and individuals entering the country through numerous airports and border crossings. The Customs Service has been in place since 1789, originally focused on collecting tariffs, which served as the government’s primary revenue source for many years. However, the introduction of the income tax in 1913 diminished the role of tariffs in revenue generation. Further changes occurred post-Sept. 11, 2001, when the Customs bureau was moved from the Treasury Department to the Department of Homeland Security.

Today, customs officials engage in a range of duties beyond tariff collection, including monitoring food safety, enforcing intellectual property laws, and inspecting imports for compliance with labor standards. The president’s directive to create the ERS raises questions about jurisdiction, as the authority to establish a new federal agency lies with Congress, not the executive branch.

In response to this directive, Trump issued an executive order on his inaugural day, instructing leaders from the Treasury, Commerce, and Homeland Security departments to explore the feasibility of the ERS and to recommend strategies for its establishment and operation.

During Trump’s previous term, tariff revenue surged significantly, with the government collecting $111.8 billion in trade duties in 2022— a stark increase from $41.6 billion in 2018, coinciding with the imposition of tariffs on foreign metals, solar panels, and a wide range of Chinese goods. The projected revenue could increase dramatically if Trump follows through on plans for a 25% tariff on imports from Canada and Mexico, with discussions also surrounding the possibility of a universal tariff on all foreign products.

Republicans, including Trump, view tariff revenue as a potential means of financing tax cuts, notwithstanding concerns among economists regarding the long-term revenue impact. Current predictions suggest that even with aggressive tariff collections, the revenue would only max out in the hundreds of billions, significantly less than the nearly $4.2 trillion collected from income and payroll taxes in the last fiscal year, highlighting tariffs as a minor supplement rather than a replacement for income tax revenues.

Importantly, while Trump claims that foreign nations will bear the burden of tariffs, the reality is that tariffs are paid by the importers of record—typically U.S. companies responsible for bringing products into the U.S. Various importers, including American firms, foreign entities, and those operating without a physical U.S. presence, engage in this process. An electronic payment system allows automatic tariff deductions from importers’ accounts upon entry of goods.

Experts note that while U.S. companies predominantly fill the role of importers, Trump’s use of the term "external" in describing the ERS has generated confusion, with legal professionals questioning how an agency might directly collect tariff payments from foreign manufacturers who are not also U.S. importers.

Critics, including customs lawyers, argue that the proposed name of the ERS is misleading and serves more as a marketing strategy. Scott Lincicome, vice president at the Cato Institute, stated that regardless of its branding, the reality remains that American consumers ultimately bear the cost of tariffs.

As the government explores this new agency, the implications of such a significant overhaul of tariff collection and the broader economic impact remain to be seen. The discussion around tariffs, tax cuts, and overall revenue generation continues to evolve as the administration outlines its plans for the future.

Stay Informed With the Latest & Most Important News

Previous Post

Next Post

-

01New technology breakthrough has everyone talking right now

01New technology breakthrough has everyone talking right now -

02Unbelievable life hack everyone needs to try today

02Unbelievable life hack everyone needs to try today -

03Fascinating discovery found buried deep beneath the ocean

03Fascinating discovery found buried deep beneath the ocean -

04Man invents genius device that solves everyday problems

04Man invents genius device that solves everyday problems -

05Shocking discovery that changes what we know forever

05Shocking discovery that changes what we know forever -

06Internet goes wild over celebrity’s unexpected fashion choice

06Internet goes wild over celebrity’s unexpected fashion choice -

07Rare animal sighting stuns scientists and wildlife lovers

07Rare animal sighting stuns scientists and wildlife lovers