Now Reading: Trump Hints at Recession as Tariffs Impact Economy

-

01

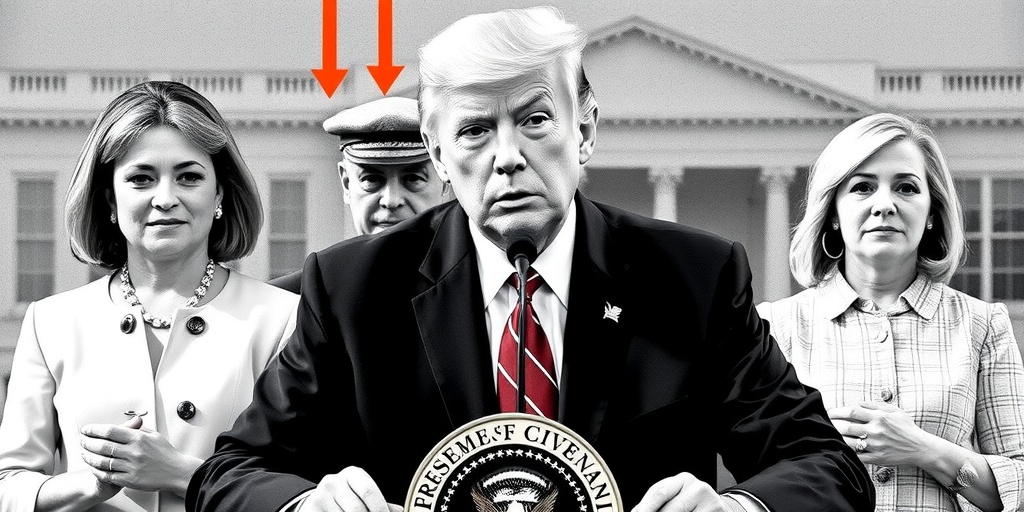

Trump Hints at Recession as Tariffs Impact Economy

Trump Hints at Recession as Tariffs Impact Economy

Trump’s Economic Policies Face Scrutiny Amid Recession Fears

In a recent interview aired on Fox News, President Donald Trump addressed concerns regarding the potential impact of his aggressive economic policies, particularly the implementation of tariffs against trade partners, on the risk of a recession in the United States. When questioned by Maria Bartiromo, the host of "Sunday Morning Futures," about expectations for a recession in the upcoming year, Trump refrained from making any definitive predictions.

“I hate to predict things like that,” Trump stated. He explained that the nation is currently in a transitional period, aiming to "bring wealth back to America" through significant changes in economic policy. While he acknowledged that such transitions might come with challenges, he expressed optimism that the outcomes would ultimately benefit the country.

Just days before the interview, Trump had announced sweeping tariffs targeting Canada, Mexico, and China, which caused significant fluctuations in stock markets and faced backlash from various industries, including major automakers. These companies communicated to the President that the duties imposed would severely harm their operations. In response, Canada immediately retaliated by implementing tariffs on $20.5 billion worth of American goods and hinted at further actions. China mirrored this approach, imposing tariffs on U.S. products and planning additional rounds shortly thereafter.

On the day of the interview, Trump had also reversed a previously announced 25 percent tariff on a wide range of Canadian and Mexican goods. However, he hinted at the possibility of imposing additional tariffs in the near future, raising concerns about a worsening global trade conflict. His administration is set to implement a 25 percent tariff on all foreign steel and aluminum, a move he had signaled in prior discussions. Additionally, he plans to introduce "reciprocal tariffs" on April 2, intending to respond to other nations’ tariffs and perceived unfair trading practices.

During the interview, Bartiromo stressed that business leaders value certainty in their operations, seeking clarity on the potential for changes in trade policies after the implementation of the forthcoming reciprocal tariffs. Trump’s reply underscored his unpredictability, stating, “We may go up with some tariffs. It depends. We may go up. I don’t think we’ll go down, or we may go up." He dismissed concerns over the lack of clarity, arguing that the U.S. has been "ripped off" in trade for decades and proposed that such policies were crucial to reclaiming economic strength.

Economists have grown increasingly pessimistic about the economic landscape amid Trump’s erratic tariff strategy, which fosters a climate of uncertainty and discourages businesses from pursuing new investments and hiring. As economic growth has slowed down, the labor market exhibits signs of cooling, and inflation, though somewhat reduced from its 2022 peaks, continues to present challenges. While the economic fundamentals remain robust by several metrics, the combination of tariffs, immigration policies, and governmental budget cuts central to Trump’s agenda could jeopardize this stability.

Tariff policies are widely anticipated to lead to higher prices for essential goods, constraining both growth and consumer spending as businesses recalibrate their resources. Elevated inflation rates constrain the Federal Reserve’s ability to stimulate the economy, with current interest rates held steady between 4.25 and 4.5 percent.

Federal Reserve Chair Jerome H. Powell confirmed that while the economy remains relatively strong, he is cautious about the potential destabilizing effects of Trump’s policies, particularly concerning inflation. The specter of stagflation, characterized by stagnant economic growth coupled with rising prices, has introduced additional worries for economic policymakers.

Dr. Austan D. Goolsbee, president of the Chicago Federal Reserve, highlighted the growing concerns among companies in his region related to an "uncertainty-induced chill," indicating that apprehensions about the economic outlook are gaining traction.

In a separate interview, Commerce Secretary Howard Lutnick expressed confidence that the administration’s tariff strategy would foster unprecedented economic growth. When confronted with recession predictions from banks like JP Morgan and Goldman Sachs, Lutnick dismissed these forecasts, stating, “I would never bet on recession. No chance.” He argued that reducing government deficits would lead to lower interest rates and that increased domestic oil production would help lower energy costs. Although he conceded that tariffs could elevate prices for foreign goods, he believed domestic products would become more competitively priced.

Contrary to Lutnick’s assertions, many economists contest that imposing tariffs on foreign imports could result in higher prices for consumers, challenging the notion that tariffs only bolster domestic goods. While the administration maintains its stance on tariffs, the long-term implications of such policies on the broader economy and potential recession scenarios remain an ongoing debate.

Stay Informed With the Latest & Most Important News

Previous Post

Next Post

-

01New technology breakthrough has everyone talking right now

01New technology breakthrough has everyone talking right now -

02Unbelievable life hack everyone needs to try today

02Unbelievable life hack everyone needs to try today -

03Fascinating discovery found buried deep beneath the ocean

03Fascinating discovery found buried deep beneath the ocean -

04Man invents genius device that solves everyday problems

04Man invents genius device that solves everyday problems -

05Shocking discovery that changes what we know forever

05Shocking discovery that changes what we know forever -

06Internet goes wild over celebrity’s unexpected fashion choice

06Internet goes wild over celebrity’s unexpected fashion choice -

07Rare animal sighting stuns scientists and wildlife lovers

07Rare animal sighting stuns scientists and wildlife lovers