Now Reading: Trump Announces 90-Day Pause on Global Tariffs

-

01

Trump Announces 90-Day Pause on Global Tariffs

Trump Announces 90-Day Pause on Global Tariffs

Trump Stuns Markets with Tariff Reversal Amid Recession Fears

In a surprising turn of events, President Donald Trump announced on Wednesday that he would pause broad global tariffs for 90 days, just hours after implementing steep levies on nearly 60 countries. The decision has sent shockwaves through financial markets, providing a much-needed relief following an intense sell-off that raised concerns about a potential recession.

The president’s abrupt reversal came amid mounting economic pressure. Many had expressed frustration over the new tariffs, which were seen as a contributing factor to significant market volatility. The S&P 500 index, which had been struggling, shot up approximately 7 percent within minutes of Trump’s announcement—marking the index’s strongest performance since March 2020, as it recovered from pandemic-induced losses. Stocks across various sectors, including airlines and technology companies, surged, with shares of major automakers like Ford and General Motors rising significantly despite ongoing tariffs on imported vehicles.

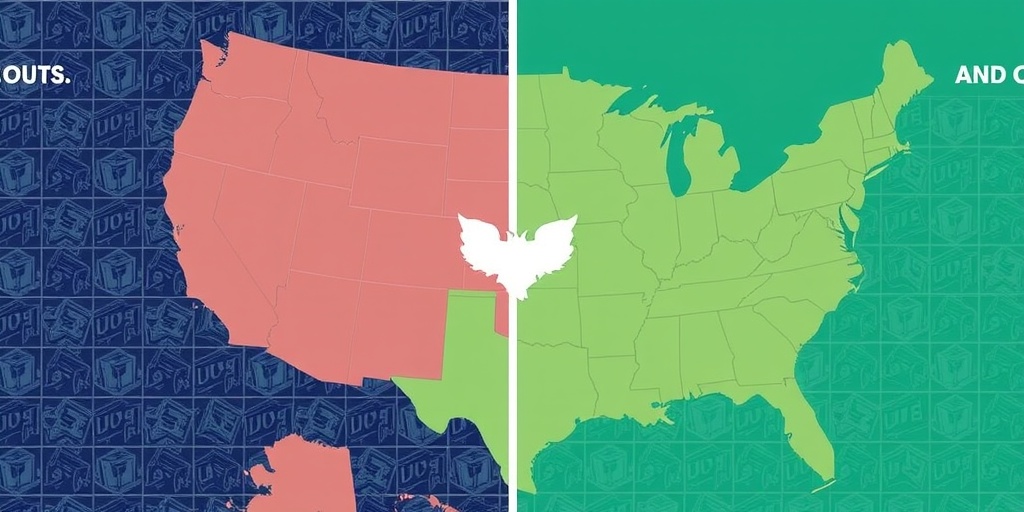

In his post on Truth Social, Trump indicated that the "90-day PAUSE" would lower tariffs to a flat rate of 10 percent for most trading partners, while maintaining an astonishing 125 percent tariff on imports from China. This decision follows China’s own increase of tariffs on U.S. goods to 84 percent, escalating an already heated trade dispute between the two largest economies in the world.

When pressed about the rationale behind pausing the tariffs so soon after implementing them, Trump acknowledged the market’s anxiety and the recent sell-off that had resulted in the loss of trillions in stock market value. "I thought people were jumping a little bit out of line… They were getting yippy," he explained, recognizing the fears that were proliferating in the investment community.

The sudden shift also reflects a broader awareness of the precarious economic situation facing the U.S. Investors turned to government bonds and the dollar as safe havens amid the turmoil, as fears of a recession loomed larger not just in stocks but across the economic landscape. Economists had been sounding alarms about a self-induced recession, further exacerbated by the administration’s aggressive trade stance.

As news of the reversal circulated, Jamieson Greer, the U.S. trade representative, testified in congressional hearings, revealing that numerous countries were rushing to negotiate with the U.S. to address ongoing tensions. Greer stated that countries such as South Korea, Mexico, and several European nations were eager for discussions, while officials from Vietnam even came prepared to reduce their own tariffs on American agricultural products.

Political reactions to the surprising tariff pause varied widely. Representative Steven Horsford, a Democrat from Nevada, criticized the move, claiming it undermined the efforts of Trump’s advisors in the hearing. "Would this amount to market manipulation?" he questioned, indicating the chaotic environment created by the administration’s unpredictable trade policies.

Despite the initial boost to the markets, many analysts remained skeptical about the long-term impact of Trump’s decision. Emily Kilcrease, a trade expert and senior fellow at the Center for a New American Security, suggested that the pause might have been a direct reaction to the stock market’s rapid decline and increasing pressure from members of Congress, including those within Trump’s own party. There was visible pushback from business leaders who feared the tariffs could disrupt their international supply chains, highlighting concerns that the administration’s approach could lead to substantial economic fallout.

In addition to tariffs, Federal Reserve officials have been vigilant about potential stagflation, a situation where rising inflation coincides with economic stagnation. With inflation rates already concerning, the Fed’s minutes from a recent meeting showed worry over risks to employment, indicating that the central bank has tough decisions ahead in stabilizing the economy amid these challenges.

Following the announcement, Trump hinted at the possibility of exempting select U.S. companies from the tariffs in addition to the 90-day pause, suggesting a less rigid and more flexible approach moving forward. “My thinking on this would be made instinctively,” he remarked, highlighting the unpredictable nature of his administration’s trade strategy.

The long-term health of the U.S. economy remains uncertain as analysts weigh the implications of the administration’s tariff policies, with many calling for a significant course correction to restore investor confidence and stabilize economic growth.

As the situation unfolds, all eyes will be on the president and his cabinet to see how they navigate these turbulent waters, particularly in an environment already fraught with economic pressures and a volatile global trade landscape.

Stay Informed With the Latest & Most Important News

Previous Post

Next Post

Previous Post

Next Post

-

01New technology breakthrough has everyone talking right now

01New technology breakthrough has everyone talking right now -

02Unbelievable life hack everyone needs to try today

02Unbelievable life hack everyone needs to try today -

03Fascinating discovery found buried deep beneath the ocean

03Fascinating discovery found buried deep beneath the ocean -

04Man invents genius device that solves everyday problems

04Man invents genius device that solves everyday problems -

05Shocking discovery that changes what we know forever

05Shocking discovery that changes what we know forever -

06Internet goes wild over celebrity’s unexpected fashion choice

06Internet goes wild over celebrity’s unexpected fashion choice -

07Rare animal sighting stuns scientists and wildlife lovers

07Rare animal sighting stuns scientists and wildlife lovers