Now Reading: IRS to Lay Off Around 6,000 Employees Starting Thursday

-

01

IRS to Lay Off Around 6,000 Employees Starting Thursday

IRS to Lay Off Around 6,000 Employees Starting Thursday

IRS to Lay Off Approximately 6,000 Employees Amid Federal Workforce Reductions

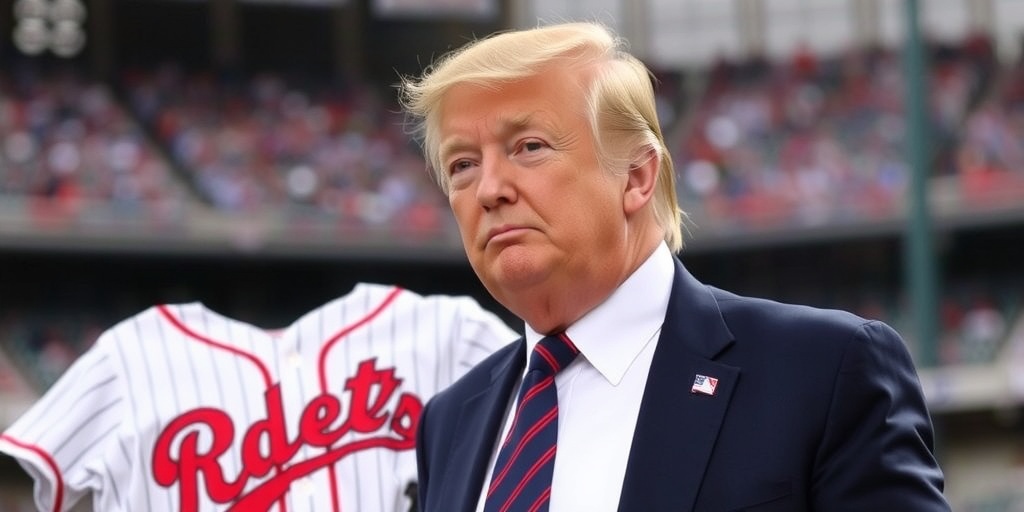

The Internal Revenue Service (IRS) is set to initiate the layoff of around 6,000 employees starting Thursday, as part of a broader objective by the Trump administration to downsize the federal workforce. This move has raised concerns among current employees and tax professionals about the implications for tax services during the peak filing season. According to sources familiar with the IRS’s plans, who requested anonymity as they were not authorized to speak publicly, these layoffs will primarily impact more recent hires at the agency.

Despite the Biden administration’s efforts to revitalize the IRS by injecting additional funding and hiring new staff, the Trump administration’s strategy focuses on personnel reductions as part of an ongoing initiative to streamline government operations. Recent communications reveal that IRS managers have begun instructing employees to report to their offices with government-issued equipment in the coming days, indicating that the process is already underway. Currently, the IRS employs a workforce of approximately 100,000 individuals, including accountants, lawyers, and diverse administrative staff.

An internal email shared with The New York Times highlights that under a recent executive order, the IRS has been directed to terminate probationary employees deemed non-essential for the ongoing tax filing season. This information comes at a particularly sensitive time, as the IRS is already experiencing significant demand from millions of Americans filing their taxes. Critics, including former IRS officials and Democratic lawmakers, have cautioned that the loss of such a significant number of employees may disrupt the efficiency and effectiveness of tax processing. The IRS and the Treasury Department did not respond to requests for comments regarding the layoffs.

Republican lawmakers have long been critical of the IRS, alleging that the agency engages in politically motivated efforts that adversely affect conservative groups. Some prominent figures within the party, including President Trump’s nominee to lead the agency, have even suggested the idea of abolishing the IRS entirely. Recently appointed to head the IRS, Billy Long, a former Republican congressman, made the unconventional move of replacing the previous commissioner, Daniel Werfel.

Under the Trump administration, the IRS has already faced restrictions, including an extended hiring freeze, which has affected the agency’s capacity to retain talent and meet growing demands. In a notable instance of resource reallocation, the Department of Homeland Security has sought assistance from IRS agents to bolster immigration enforcement efforts. Additionally, members of what has been referred to as Elon Musk’s ‘Department of Government Efficiency’ have expressed interest in gaining extensive access to sensitive taxpayer records held by the IRS.

As these layoffs unfold, many IRS employees are now seeking employment opportunities within the private sector, particularly in law and accounting firms. Dave Kautter, a former acting head of the agency and a Treasury Department official during Trump’s first term, remarked, "There’s a flood of résumés from people at the IRS looking for jobs throughout the tax community. Law firms are getting a fair number of résumés, and accounting firms are also seeing an influx."

The situation remains fluid, as both the IRS and the federal administration navigate the challenges of managing a significant workforce reduction while simultaneously facing peak operational demands during tax season. The decisions being made now could have long-lasting impacts on the agency’s ability to function effectively and serve the public in future tax years. As the layoffs continue, the repercussions will likely be felt by millions of taxpayers across the nation, underscoring the complex interplay between political strategy and the essential services provided by the IRS.

Stay Informed With the Latest & Most Important News

Previous Post

Next Post

-

01New technology breakthrough has everyone talking right now

01New technology breakthrough has everyone talking right now -

02Unbelievable life hack everyone needs to try today

02Unbelievable life hack everyone needs to try today -

03Fascinating discovery found buried deep beneath the ocean

03Fascinating discovery found buried deep beneath the ocean -

04Man invents genius device that solves everyday problems

04Man invents genius device that solves everyday problems -

05Shocking discovery that changes what we know forever

05Shocking discovery that changes what we know forever -

06Internet goes wild over celebrity’s unexpected fashion choice

06Internet goes wild over celebrity’s unexpected fashion choice -

07Rare animal sighting stuns scientists and wildlife lovers

07Rare animal sighting stuns scientists and wildlife lovers