Now Reading: Fed Exits Global Climate Network Ahead of Trump Presidency

-

01

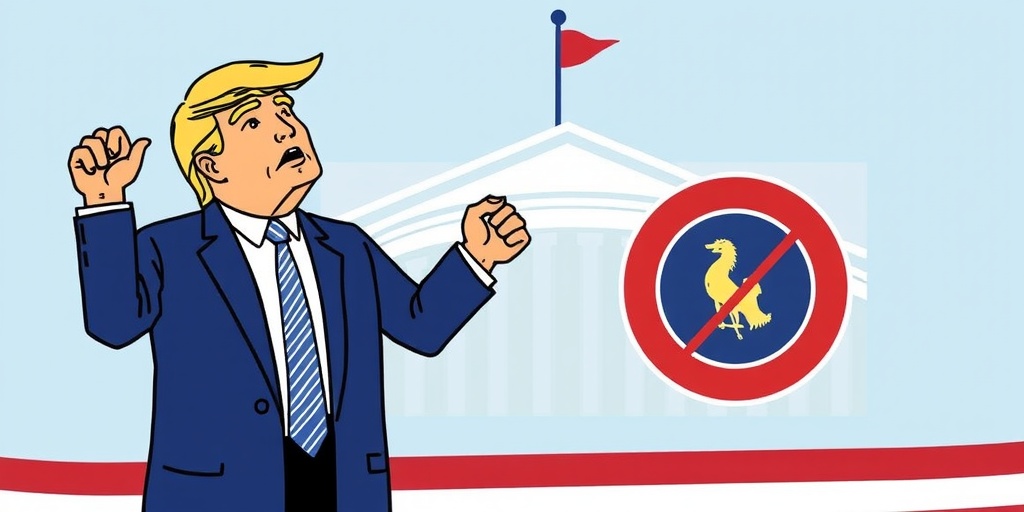

Fed Exits Global Climate Network Ahead of Trump Presidency

Fed Exits Global Climate Network Ahead of Trump Presidency

Federal Reserve Withdraws from Global Climate Risk Network Ahead of Trump’s Return to Power

In a significant shift in its policy regarding climate-related financial risks, the Federal Reserve has announced its decision to withdraw from a prominent network of global financial regulators. This decision comes just days before President-elect Donald J. Trump is set to return to power, marking a notable departure from the Fed’s previous engagement with climate risk.

The Federal Reserve initially joined the Network of Central Banks and Supervisors for Greening the Financial System (NGFS) in December 2020, shortly after President Joe Biden’s election victory. The move was well-received by Democrats, who viewed it as a necessary step toward acknowledging the significance of climate risks in financial markets. However, it also raised concerns among Republican lawmakers, who expressed apprehension that increased focus on climate risk could inadvertently harm American consumers and businesses by complicating access to necessary financial resources.

The NGFS was established to facilitate collaboration among central banks and financial regulators in sharing best practices, research, and ideas on how to better account for climate-related risks in the financial landscape. The network’s mission includes mobilizing mainstream finance to support the transition towards a sustainable economy, emphasizing the importance of integrating environmental considerations into financial decision-making.

In a statement released on Friday, the Federal Reserve clarified that its withdrawal was motivated by a perceived expansion in the network’s scope. “While the Board has appreciated the engagement with the NGFS and its members, the work of the NGFS has increasingly broadened in scope, covering a wider range of issues that are outside of the Board’s statutory mandate,” the central bank stated. This statement indicates a pivot in the Fed’s focus, favoring a more conservative approach to its regulatory role and responsibility.

As the announcement unfolded, notable figures within the Fed were instrumental in the decision to part ways with the network. Five members of the Federal Reserve’s Board of Governors voted in favor of the withdrawal, including Fed Chair Jerome H. Powell. Despite the support for the withdrawal, two members—Adriana Kugler and Michael Barr—chose to abstain from the vote. Barr recently announced plans to resign from his position as vice chair for supervision by the end of February 2025, adding an additional layer of transition to the board’s leadership dynamics.

The Fed’s initial decision to join the NGFS was seen as a crucial acknowledgment of the growing impacts of climate change on the financial system. Severe weather events and their increasing frequency were starting to pose significant risks to financial stability, prompting regulators to consider these factors in their risk assessment frameworks. Prior to its formal membership, the Fed had informally engaged with the network for over a year, signaling a serious consideration of the role climate issues play within the broader economic landscape.

The timing of the Fed’s withdrawal has raised eyebrows, particularly given the incoming administration’s historical skepticism toward regulatory measures linked with climate change. Just days before the Fed officially joined the NGFS, a group of Republican lawmakers expressed doubts about the necessity of the Fed’s involvement, citing potential consequences of adhering to the network’s recommendations. They warned that the guidelines could "significantly limit access to capital for crucial industries and place harmful restrictions on regulated entities," echoing broader concerns about the implications of climate-driven regulations on economic growth.

The Fed’s disengagement from the NGFS could signal a cooling of regulatory enthusiasm for climate-related financial risks, especially as the new administration may pursue policies that prioritize traditional economic considerations over emerging environmental concerns. As climate-related financial risks continue to be a pressing issue globally, the implications of the Fed’s withdrawal could potentially reverberate across various sectors, influencing how financial institutions approach climate risk management and investment strategies moving forward.

As discussions surrounding financial stability and climate risk evolve, the future path of the Fed’s policies regarding environmental factors in financial regulation remains to be seen. Analysts and industry experts will be closely monitoring how the Federal Reserve under Trump’s leadership reconciles the necessity of robust financial oversight amidst growing climate-related challenges. The balance between ensuring economic vitality and addressing environmental realities will undoubtedly shape the regulatory landscape in the years to come.

Stay Informed With the Latest & Most Important News

Previous Post

Next Post

-

01New technology breakthrough has everyone talking right now

01New technology breakthrough has everyone talking right now -

02Unbelievable life hack everyone needs to try today

02Unbelievable life hack everyone needs to try today -

03Fascinating discovery found buried deep beneath the ocean

03Fascinating discovery found buried deep beneath the ocean -

04Man invents genius device that solves everyday problems

04Man invents genius device that solves everyday problems -

05Shocking discovery that changes what we know forever

05Shocking discovery that changes what we know forever -

06Internet goes wild over celebrity’s unexpected fashion choice

06Internet goes wild over celebrity’s unexpected fashion choice -

07Rare animal sighting stuns scientists and wildlife lovers

07Rare animal sighting stuns scientists and wildlife lovers