Now Reading: Republicans Aim to Permanently Extend Trump Tax Cuts

-

01

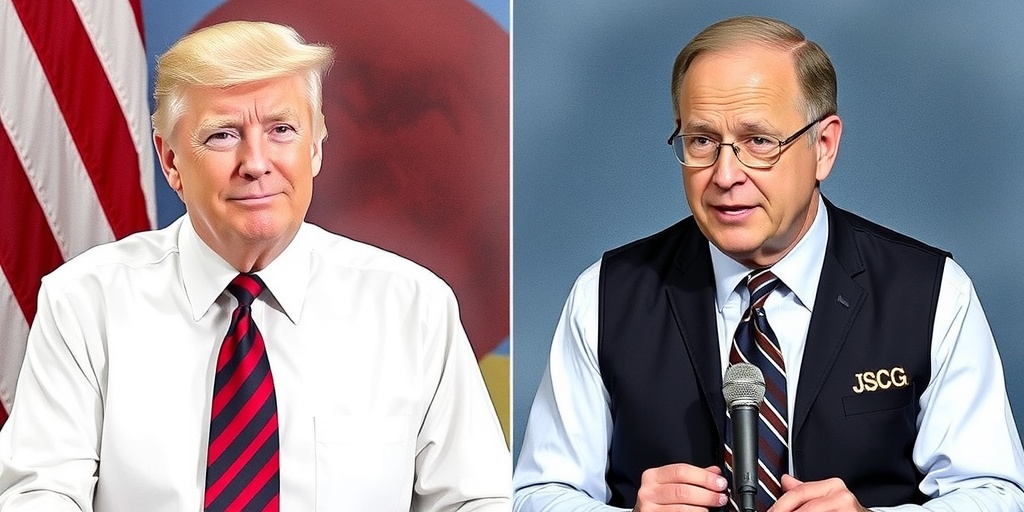

Republicans Aim to Permanently Extend Trump Tax Cuts

Republicans Aim to Permanently Extend Trump Tax Cuts

Republicans Seek to Secure Trump Tax Cuts Indefinitely Amid Budget Challenges

Amid ongoing discussions about tax policy in Washington, Republicans are making a strategic play to extend the tax cuts implemented during the Trump administration permanently. Unlike previous instances where tax cuts were temporarily enacted due to strict budgetary rules, this time, many GOP lawmakers express a strong desire to bypass the traditional negotiation processes with Democrats that accompanied earlier cuts.

Recently, Senate Republicans approved a budget outline that could potentially allow them to lock in the Trump tax cuts without needing Democratic support. However, achieving this goal would necessitate significant changes to the established Senate procedures that govern party-line actions. Such a move could dramatically alter bipartisan legislative dynamics and set a precedent for Democrats to enact major policies when they regain control.

Understanding the historical context is crucial: when Republicans previously enacted tax cuts, they were often temporary, with built-in expiration dates to adhere to budgetary constraints imposed by the reconciliation process, which allows legislation to pass with a simple majority but carries strict rules regarding fiscal impact. With many Trump-era cuts set to expire this year, lawmakers face what has been termed a "fiscal cliff," which would lead to tax increases for numerous Americans unless Congress acts.

As Senate Republicans find themselves in a commanding position with both Congress and the White House, they recognize the opportunity to advance their tax agenda without facing opposition from Democrats—many of whom have advocated for rolling back certain tax cuts. Nonetheless, some GOP members express concern about the future, anticipating that Democrats could wield more influence in subsequent tax negotiations.

A vocal advocate for the permanence of tax cuts, Grover Norquist, president of Americans for Tax Reform, highlighted the necessity of addressing the looming fiscal cliff. He noted that any future increases in tax rates due to negotiations over spending could risk GOP concessions that would tie tax cuts to increased spending or liberal tax policies.

Despite the prospect of permanent cuts, the reality of legislative change remains fluid. Any decision to modify tax policy will ultimately depend on congressional action, which tends to occur only when facing imminent deadlines. Historical patterns reveal that tax cuts are often entrenched in the American economic landscape, as citizens become accustomed to lower tax bills, making outright repeals politically perilous for lawmakers.

For example, when former President Obama took office, he opted to preserve many of the Bush-era tax cuts in a bipartisan agreement, a move that underscores the inertia inherent in tax legislation. Similarly, Democrats have indicated they would likely maintain many aspects of the Trump tax cuts if they were to lapse, particularly not raising taxes on individuals earning less than $400,000 annually, while advocating for higher corporate taxes.

The current GOP strategy hinges on changing how tax cuts are accounted for in the budget process. Republicans propose to interpret the extension of the Trump tax cuts not as a new expense but as a continuation of existing policy. By adopting a "current policy baseline," the plan effectively avoids further deficit implications associated with newly proposed tax cuts, which typically require budgeting around potential future costs.

This shift in accounting standards, spearheaded by Senator Lindsey Graham and his colleagues, allows Republicans to project that extending tax cuts would not add to the deficit. However, this approach has drawn criticism, with analysts labeling it a gimmick that undermines traditional budgeting practices. Questions remain regarding the approval of this tactic by the Senate’s parliamentarian, the official responsible for interpreting reconciliation rules.

Economists have raised alarms over the potential fiscal implications of maintaining the Trump tax cuts long term. The Congressional Budget Office has projected that continuing these cuts could increase the national debt significantly over time, raising concerns even among fiscally conservative Republicans. As debates continue, concerns linger about the sustainability of such budget strategies and the broader implications for future fiscal health.

The outcome of these negotiations will likely shape the political landscape ahead, demonstrating the ongoing tug-of-war over tax policy between Republican ambitions and Democratic countermeasures. As both parties grapple with these critical fiscal questions, the stakes remain high, influencing not only today’s economic policies but also the potential burden on future generations.

Stay Informed With the Latest & Most Important News

Previous Post

Next Post

-

01New technology breakthrough has everyone talking right now

01New technology breakthrough has everyone talking right now -

02Unbelievable life hack everyone needs to try today

02Unbelievable life hack everyone needs to try today -

03Fascinating discovery found buried deep beneath the ocean

03Fascinating discovery found buried deep beneath the ocean -

04Man invents genius device that solves everyday problems

04Man invents genius device that solves everyday problems -

05Shocking discovery that changes what we know forever

05Shocking discovery that changes what we know forever -

06Internet goes wild over celebrity’s unexpected fashion choice

06Internet goes wild over celebrity’s unexpected fashion choice -

07Rare animal sighting stuns scientists and wildlife lovers

07Rare animal sighting stuns scientists and wildlife lovers